LRP – Livestock Risk Protection

Livestock Risk Protection (LRP) is a Federal Crop Insurance program that livestock producers can use to manage their market (price) risk. In some respects, LRP is similar to other price risk management tools, such as forward contracting or hedging with futures and options contracts. But in other ways it is quite different.

A producer can use LRP to protect against downward movement in their selling price during the time that they own they own livestock and before the animals are sold. In this way, LRP is similar to a forward contract. However, an important difference between these instruments is that, while the selling price is fixed under a forward contract, LRP instead provides price insurance.

LRP insurance establishes a guaranteed minimum selling price, known as the “price guarantee.” This is the lowest price the insured producer will receive for the livestock if the market price drops before the date of sale. On the other hand, if market prices rise the insured producer will still receive the higher price for their livestock. In contrast to a forward contract, a producer who purchases LRP does not lose the opportunity to take advantage of a strong market if it develops later in the insurance period. For this reason, the producer must pay an insurance premium for the price guarantee offered by LRP.

Recall that there was no cost to the producer when signing a forward contract. One way of to think about the difference between a forward contract and LRP insurance is to consider that the cost of a forward contract is giving up your possibility of a reward in the event that prices move in your favor. The cost of LRP is an insurance premium that you pay to guarantee a minimum price.

EXAMPLE:

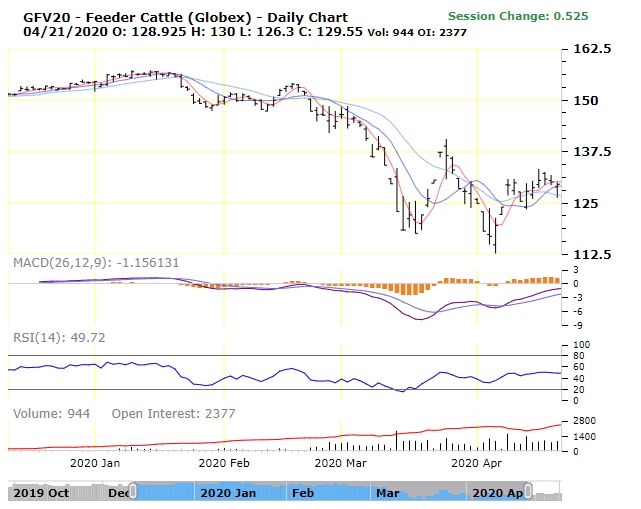

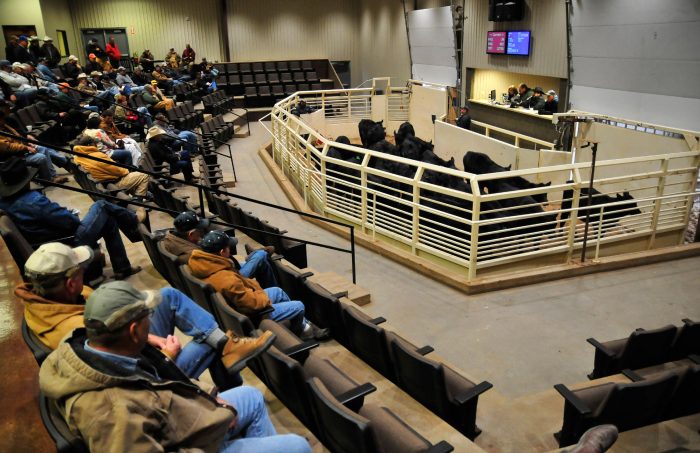

It is May and you own calves that you expect to sell at your local auction barn in October. Based on the current price of October futures contracts for feeder cattle, you can expect to sell your calves in October for $1.00/lb. Because you know that actual market prices in October could be lower than the $1.00 you expect, you purchase LRP and pay an insurance premium for the coverage. You choose a 95% coverage level for LRP coverage, so your guaranteed price is 95 cents per pound.

Fast forward to October and consider two possible scenarios:

1) Suppose the market has gone down by 10 cents and your calves are now worth 90 cents / lb. Because you purchased LRP insurance, you will receive an indemnity payment for the difference between your 95 cent guarantee and the 90 cent actual price (equal to 5 cents per pound).

2) Suppose the market instead has gone up by 10 cents to $1.10/lb. You don’t receive an indemnity payment for your insurance, but you get to sell your calves in the market at a higher price.

For the price of an insurance premium, LRP protects you against downside price risk while allowing you to still benefit when the market goes up. In the example above, you might also have considered forward contracting your cattle at $1.00/lb. In that case, you would have received $1.00/lb. no matter what happened in the market. You wouldn’t have lost money in scenario 1 or made money in scenario 2 and you wouldn’t have paid an insurance premium.

LRP is available for cattle (both feeder and fed varieties), swine, and lambs. Some actual program rules may differ from the above example. For details see the RMA website: https://www.rma.usda.gov/Policy-and-Procedure/Insurance-Plans/Livestock-Insurance-Plans